The public issue of equity shares of DIVGI TORQTRANSFER SYSTEMS LIMITED will open for subscription on March 01, 2023 and closes on March 03, 2023. It is expected to list on the stock exchanges on March 14, 2023. What does the company do? Why is the company going public? Who are its key competitors? Its key strengths, and lot more. Here’s everything that you want to know about the company to analyse the IPO.

Company Profile

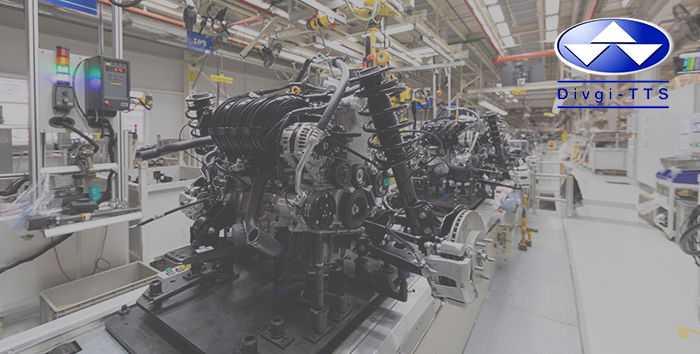

Incorporated in 1964, the company is amongst the very few automotive component entities in India who have the capability to develop and provide system level transfer case, torque coupler and Dual Clutch automatic Transmissions (“DCT”) solution. They are one of the leading players supplying transfer case systems to automotive OEMs in India and the largest supplier of transfer case systems to passenger vehicle manufacturers in India. The company also has the capability to develop and provide transmission systems for electric vehicles (“EVs”). They are in the process of designing and developing prototypes of transmission systems for EVs pursuant to receipt of a business award for this purpose. Company’s diverse capabilities enable them to service customers across segments in the automotive industry, including passenger vehicles, utility vehicles and commercial vehicles.

The company manufactures and supply a variety of products under 3 broad categories:

-

(i) Torque Transfer Systems (which includes FourWheel- Drive and All-Wheel-Drive products)

-

(ii) Synchronizer Systems for Manual Transmissions and DCT

-

(iii) Components for the above-mentioned product categories for torque transfer systems and synchronizer systems in manual transmission, DCT, and EVs.

They have also developed (i) transmission systems for EVs; (ii) DCT systems; and (iii) rear wheel drive manual transmissions.

They have entered into a Product Development Agreement and a Technology Transfer Agreement with a German automotive company. Pursuant to these agreements, the Company is co-developing critical components and systems for DCT applications with exclusive rights for India and non-exclusive rights for markets outside India.

The company has 3 manufacturing and assembling facilities across India located at Sirsi in Karnataka, and Shivare and Bhosari near Pune in Maharashtra. Their key customers include marquee domestic and global OEMs in the automobile sector, such as BorgWarner, Tata Motors and Mahindra & Mahindra, amongst others.

Who are the Promoters of the Company?

Jitendra Bhaskar Divgi, Hirendra Bhaskar Divgi and Divgi Holdings Private Limited

Why is the Company going public?

Given below are the objectives of the Company –

The Offer comprises a Fresh Issue by the company and an Offer for Sale by the selling shareholders. The company will not receive any proceeds from the Offer for Sale.

The Company proposes to utilise the Net Proceeds from the Fresh Issue towards funding of the following objects:

-

Funding capital expenditure requirements for the purchase of equipments/machineries of our manufacturing facilities

-

General Corporate Purposes

Don’t have Wealthstreet account? No worry, just go to our IPO platform, create a guest login and apply for the IPO easily! Click the “Apply Now” button below.

Apply online in just 5 minutes!

Apply Now Investment in securities market is subject to market risks, read all the related documents carefully before investing.

079-66775500

079-66775500 welcome@wealthstreet.in

welcome@wealthstreet.in A-1101, Mondeal Heights,

S.G. Highway, Ahmedabad - 380015

A-1101, Mondeal Heights,

S.G. Highway, Ahmedabad - 380015